LA Car Crash Death Odds

September 23, 2022

Networking: A Step into the Real World

September 23, 2022When you’re buying a house, there’s a whole lot of jargon to wrap your head around. When you’re a lawyer working on a property dispute or asset allocation, there’s even more! If you’re working on a UK property case, it’s likely you’re going to come across the term “stamp duty” fairly frequently, referring to Stamp Duty Land Tax – depending on what sort of matter you’re dealing with, of course.

But what is stamp duty, and how much do different households have to pay? Here’s everything you need to know.

What is Stamp Duty?

Stamp Duty is a tax on certain properties in England and Northern Ireland payable in one lump sum. In Scotland, it’s known as Land and Building Transaction Tax (LBTT), and in Wales, it’s known as Land Transaction Tax (LTT), though the concept is the same. Essentially, when an individual buys either a piece of land or property in the UK, they usually have to pay tax on their purchase. For the sake of simplicity, whenever we refer to stamp duty on a property from now on, this also refers to land.

Stamp Duty is applicable for both leasehold and freehold purchases, as well as shared ownership residencies and any property that’s exchanged for a fee, such as when an individual takes out a mortgage.

Who Pays Stamp Duty?

In general, the individual responsible for paying stamp duty is the one who is buying or receiving the property. If the property is a gift, though, all parties can be held accountable for paying stamp duty. Occasionally, the solicitor aiding in the sale or transfer of the property will pay for the stamp duty as part of their services: this is lawful though not required.

As of October 2021, the threshold for paying stamp duty on a residential property is £125,000. Any property bought for a value below this is exempt from the tax payment, though a return still must be submitted. For non-residential properties, the threshold increases to £150,000.

Be aware, though, that these rules vary for first-time buyers due to the relief available. Rules on stamp duty for additional properties also vary, which we’ll look at in more detail later. Any other different routes to buying a property, such as through a bad credit mortgage lender or in cash, have the same rules as any other buyer and must pay stamp duty.

When is Stamp Duty Not Payable?

There are a few cases where stamp duty doesn’t need to be paid. The first is when the property is transferred under a court order during a divorce, dissolution, or separation. If the couple divorces without a court order, however, this doesn’t apply.

Property that’s received under the conditions of a will may also be exempt from stamp duty. If this is the case, HMRC doesn’t need to be informed. If the property is received as a gift without an outstanding mortgage, stamp duty won’t need to be paid. If the recipient is taking on some or all of the mortgage, though, it is likely a tax sum will need to be covered.

How Much Do Different Households Pay?

How much stamp duty you have to pay on a property varies depending on the property’s value. The system is a little complex and works in the same way as income tax.

The first band is any property valued below £125,000, for which the stamp duty rate is 0%, and you aren’t required to pay any tax. The next band is for property valued between £125,001 and £250,000, for which the stamp duty rate is 2%. So, you’ll pay an additional 2% on the value of your property.

The next band – which is between £250,000 and £925,000 – has a stamp duty rate of 5%. However, rather than paying 5% of the total property value, you only pay 5% for anything over £250,000. Anything paid up to £250,000 remains at 2%.

To break that down, if a property costs £350,000, here’s how you’ll pay stamp duty tax on that value:

- 0% up to £125,000 = £0

- 2% from £125,001 to £250,000 = £2,500

- 5% from £250,001 to £350,000 = £5,000

So the total stamp duty is £7,500.

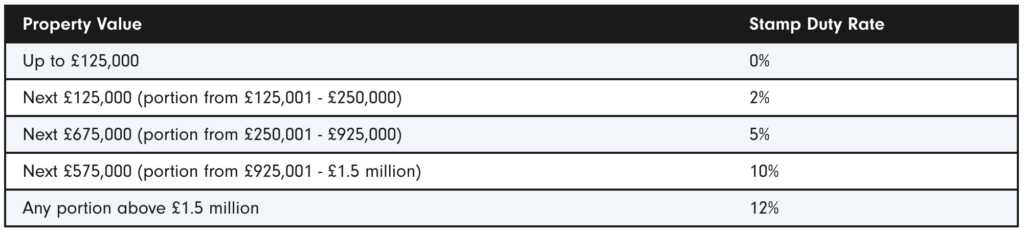

Stamp Duty Bands

Rates are separated into bands and calculated as a progressive rate system. Here’s a simple look at the stamp duty percentages for different property values as explained by Online Mortgage Advisor below:

This means that, rather than paying a flat rate for the whole property, you pay a different percentage on each portion of it according to the price.

Is There a Stamp Duty on Second Properties?

For anyone buying an additional property, such as a second home, you’ll pay a larger stamp duty fee of an extra 3% on top of existing stamp duty. Do note that this doesn’t apply to mobile homes, caravans, and houseboats. It also only applies to any property that’s bought for over £40,000. Here’s a look at the adjusted rates:

- £0 – £125,000 : 3%

- £125,001 – £250,000 : 5%

- £250,001 – £925,000 : 8%

- £925,001 – £1million : 13%

- Over £1.5 million : 15%

Final Words

Stamp duty is an important legal aspect of property sales and can be pretty confusing if you don’t already know about it. Fortunately, this article should have given you all of the information you need! If you’re ever dealing with property in a legal case in the future, such as helping an individual with a will or negotiating a divorce settlement, you’ll be ready to tackle any stamp duty issues with ease.