Herculito Maritime Ltd and Others (Respondents) v Gunvor International BV and Others (Appellants) [2024] UKSC 2

April 1, 2025

WH Smith’s High Street Disappearance: A Landmark £76 Million Sale

April 5, 2025Written by Elizabeth Mamah

Introduction

Despite significant policy shifts from the Obama administration to President Trump’s, US oil production has steadily increased over the years. This is because much of the country’s oil production is undertaken on private lands, which are less directly affected by federal regulations. This article will explore how the Trump administration is attempting to accelerate this trend by deregulating federal lands and influencing global oil markets, climate policies, and geopolitical dynamics.

Background: The Shifting Oil Policies

Trump (2017 – 2021): Deregulation

President Trump’s first term reversed what former US President Obama had put in place. This created a shift towards the deregulation of federal lands with the ultimate aim of expanding fossil fuel production and building energy independence for the USA.

A notable example of this policy shift was when President Trump issued a presidential memorandum, favouring the Keystone XL and Dakota Access Pipelines, to show a commitment to increasing fossil fuel infrastructure. Additionally, his executive orders repealed environmental regulations by Barack Obama, such as the Clean Power Plan and the Methane Waste Prevention Rule, which he argued were obstacles to the oil industry’s expansion. Moreover, Trump’s withdrawal from the Paris Agreement highlighted his priority to boost US oil production, even at the expense of significant environmental impacts.

These pro-fossil fuel actions boosted US oil production, and under President Trump, the US became a net oil exporter for the first time in decades.

Biden (2021 – 2025): A Green Transition and Energy Security

Former President Biden’s approach to US oil policy was a more nuanced balancing act between pursuing renewable energy goals and maintaining oil production for energy security.

Under Joe Biden, the US re-joined the Paris Agreement, reaffirming its commitment to global climate goals, and his administration pushed for clean energy investments through subsidies and incentives for renewable technologies. This mirrored former President Obama’s approach almost exactly. However, the Biden administration faced challenges balancing these green energy goals with the need for domestic oil production to ensure energy security, especially amid rising global oil prices and geopolitical tensions.

Despite former President Biden’s emphasis on renewable energy, US oil production continued to rise, though at a slower rate than it did during President Trump’s first term.

Trump 47: A Return to ‘Drill, Baby, Drill’ and Deregulation

Looking ahead, Donald Trump’s attitude in his 2024 campaign presented a return to aggressive fossil fuel expansion like in his first term. In speeches, he emphasised his commitment to “drill, baby, drill” and promised to increase oil production with little regard for environmental concerns.

To understand the effects of this approach, one must understand how the division between private and federal lands shapes oil production in the US. While the Trump administration’s regulatory rollback affected federal lands, much of the oil production that has driven recent growth in the US has occurred on private lands.

Oil Production: Private vs Federal Lands

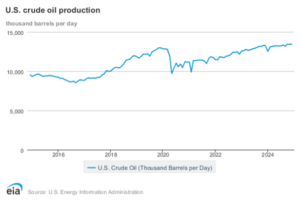

There have been significant fluctuations in the approaches taken by each administration regarding oil production. One might expect this to affect national oil production significantly, but that has not been the case. National oil production has been steadily rising, with only a slight decrease in 2020 due to the COVID-10 pandemic. This trend is evident in Figure 1 from the US Energy Information Administration.

Figure 1: US crude oil production

This rise, regardless of the administration, is due to most of the oil production occurring on private lands. In 2024, 43% of US oil production was undertaken in Texas. However, it raises an important question: how much of that production takes place on private land? Figure 2 illustrates the distribution of US federal lands, showing that most federal lands are on the US West Coast, with barely any covering Texas.

Figure 2: US Federal Lands

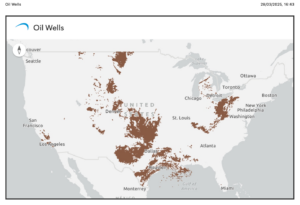

In contrast, Figure 3 from the US Energy Atlas shows the oil wells across the US.

Figure 3: US Oil Wells

Figure 3 shows that most oil wells are outside of federal lands. Therefore, it follows that, despite drastic shifts in oil policy, national oil production continued to increase across administrations as the oil companies operating on private lands were not as affected as those operating on federal land. This is because landowners have more freedom to use their property, as private lands are regulated by the State, compared to federal lands.

The Obama and Biden administrations were more stringent, prioritising stricter oil policies that limit the impact of federal lands on the environment. For example, the Paris Agreement and Biden’s executive orders aimed to halt new oil and gas leases on federal lands. They were designed to transition to clean energy and curb carbon emissions, limiting expansion in these regions.

In contrast, President Trump’s lenience on oil policy was reflected in his withdrawal from the Paris Agreement and his elimination of more than 70 climate and green energy initiatives within his first week in office. Donald Trump’s emphasis on energy dominance, in pushing for expanded drilling on federal lands, sharply contrasts with the stringent regulatory-monitoring introduced by the Obama and Biden administrations.

Interestingly, New Mexico, which has fewer oil wells, is the second largest oil producer in the US, making up 15% of oil production as of 2024. However, this is likely due to its proximity to the Permian basin, which, with new technologies, has seen an increase in oil production. With federal restrictions under Trump being reduced and the utilisation of these technologies, Trump would be living up to his promise to “drill, baby, drill” as he continues to widely promote flexibility enjoyed by private landowners.

Global and Commercial Implications

President Trump’s focus on fossil fuels and reluctance to prioritise renewable energy has accelerated the global debate on energy transition, especially as these US policies have had an indirect effect on the global market.

The UK, which has pushed for more renewables, has become more cautious after Donald Trump criticised its shift away from North Sea oil and gas by banning new exploration licences. These criticisms are becoming a pattern for President Trump, who frequently weighs in on the domestic policies of other nations. President Trump’s policies have been indirectly encouraging oil and gas companies like BP, who had scrapped their 5-year energy transition strategy and announced it would increase oil and gas spending by a fifth (to $10bn a year) to continue or even increase oil and gas activities as the US moves toward deregulation. This shift encourages oil companies worldwide to adopt similar strategies as the less restrictive policies are seen as favourable for profitability.

As US oil companies benefit from relaxed regulations, they may push for deregulation in other regions, influencing global energy production strategies and potentially leading to more oil exploration and production internationally. The contrast between the US’s deregulation and the more stringent energy policies in areas like Europe could result in a redirection of investments towards US oil projects, further intensifying competition for global resources. Similarly, Trump’s push for the EU to buy US oil or “face tariffs” is part of President Trump’s broader strategy to achieve energy dominance, i.e. being free of the instability caused by other nations that use energy as a tool for economic leverage. President Trump has used this strategy with other countries like Canada and Mexico when he imposed 25% tariffs on imported goods (and 10% on Canadian oil), which added pressure on the oil market through several means. For example, the market uncertainty caused by these tariffs may lead to a rise in global oil prices in response to fears of supply disruptions, as the market may fear that this sets a precedent for escalating trade wars that affect other regions and oil exports. This ultimately may push the US towards greater energy independence as companies rely more on domestic oil rather than imported oil to avoid tariffs, which could create a lower-risk environment for investors if it fosters stability in the US energy market as a result of a reduced reliance on foreign energy sources.

Additionally, President Trump has influenced the global oil market by pushing the Organization of the Petroleum Exporting Countries (OPEC) to reduce global oil prices. OPEC+ (consisting of OPEC members and non-members) in March 2025 confirmed that they will increase oil production, causing oil prices to drop as more oil is available. This decision was largely influenced by concerns about the potential impact of US tariffs, some of which President Trump had already put in place. The issue with this for oil companies is that it creates uncertainty for the future in how these countries may retaliate, with the potential for an oversupply of oil soon, leading to increased market volatility. Oil companies would need to adopt more cautious approaches, especially those with higher production costs, as they could face problems with lower profit margins if prices fall. A recent Dallas Fed survey shows that these problems have already surfaced as some shale executives have had to reduce their 2025 and 2026 capital expenditures. This is evidence that the consequences of excessive oil production go beyond environmental concerns and need further addressing.

Conclusion

The steady rise in US oil production, despite varying political landscapes, highlights the critical role of private land in shaping the nation’s energy future. President Trump’s deregulation and political influence strive for higher oil production not only in the US but also globally. As US oil production continues to grow, largely unaffected by federal regulations, the broader implications of these shifts will be felt globally, impacting international trade and oil prices.

In this ongoing push for oil production, it’s crucial to remain environmentally conscious and take responsibility for the impact of oil and gas activities on the environment. The current situation raises important questions about whether the “drill, baby, drill” approach is financially and environmentally sustainable, as well as the potential consequences of climate change.

Sources

https://www.fcc.gov/general/american-recovery-and-reinvestment-act-2009

https://www.iea.org/policies/87-mandatory-reporting-of-greenhouse-gases-rule#

https://www.obama.org/stories/paris-climate-agreement/

https://eelp.law.harvard.edu/tracker/bam-methane-waste-prevention-rule/

https://www.ft.com/content/ef3dbff6-e24c-11e6-8405-9e5580d6e5fb

https://www.nytimes.com/2017/03/28/climate/trump-executive-order-climate-change.html

https://www.ft.com/content/9cbba7b0-12dd-11ea-a7e6-62bf4f9e548a

https://news.stanford.edu/stories/2017/10/effects-rolling-back-clean-power-plan

https://www.bbc.co.uk/news/science-environment-54797743

https://www.bbc.co.uk/news/science-environment-55732386

https://www.reuters.com/graphics/USA-BIDEN/OIL/lgpdngrgkpo/

https://www.nytimes.com/2024/07/19/us/politics/trump-rnc-speech-transcript.html

https://www.bbc.co.uk/news/articles/ced961egp65o

https://www.whitehouse.gov/presidential-actions/2025/01/declaring-a-national-energy-emergency/

https://atlas.eia.gov/apps/e1c92d7601b9490697d22dfe2da1b4ac/explore

https://www.eia.gov/petroleum/production/

https://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbbl_a.htm

https://www.ft.com/content/c76943c6-38e5-46e7-9a8b-58ab638ed04f

https://www.ft.com/content/db14493f-ad54-4139-bf79-0c6d4db59d2f

https://www.ft.com/content/c7fab097-ecb7-469a-86cd-37fca4ca8e2a

https://www.ft.com/content/8bcf131f-c820-493f-8ea6-6a35440facd3

https://www.ft.com/content/06a1aff2-5a11-41b6-a095-af683c26af5c

https://www.ft.com/content/9e485614-0080-4a09-8fcb-2df6c3d932a5

https://www.ft.com/content/b9101226-edc1-4cde-93ec-186bc95021d7

https://www.ft.com/content/6e1a2bbb-09a5-405f-81c6-5f8c64315fd1

https://www.ft.com/content/af9a3a17-cf32-4d4c-b2e1-97ea7c5e2bb1

https://www.ft.com/content/d10a6888-f917-46cf-834b-20f67a5c60c3

https://www.ft.com/content/192de972-4661-40ce-a649-6a5476ae5c18